Analyses & Studies • Partners

French-Georgian Relations

Economic relations

French-Georgian Relations

EU-Georgia relations are governed by the Association Agreement, signed in 2014 that entered into force on 1 July 2016, which includes a Deep and Comprehensive Free Trade Area (DCFTA). Georgia is an important partner in the framework of the EU's European Neighborhood Policy.

The liberalization of the short-stay visa regime took effect on 28 March 2017. Acceleration of emigration.

EU assistance in Georgia is equivalent to 120 million euros a year. It focuses on the reform of public administration and justice, rural development, education, and the promotion of civil society.

The EU is Georgia's largest trading partner (29% of trade in 2018). In particular, the DCFTA helped stimulate imports from Europe (+ 19%).

Macroeconomic perspectives

South Caucasus Second Economy: GDP of USD 17 billion, GDP / Cap USD 4400

Growth is solid in 2018 at 4.8% with a forecast in 2019 prev. at 4.6%.

Main aggregates

| 2018 | 2019 | |

| External account | Existing balance (%GDP) | -9 | -9.3 |

Total exports (Billion USD) | 4,4 | 4,7 | |

Total imports (Billion USD) | 8.7 | 9.4 | |

External debt (Billion USD) | 18 | 19.5 | |

Foreign exchange reserve (by month of importation | 3.3 | 3.3 | |

| Banking sector | Own funds (% of total assets) | 22.5% | - |

Credits/Deposits | 107% | - | |

Doubtful loan ratio | 2.7% | - | |

| Public finances | Public debt (% GDP) (external debt) | 43.3 (108,9) | 43.5 (113.3) |

Government budget balance (% GDP) | -2.8% | -2.6% | |

Compulsory contribution rates | 27.9 | 28 | |

Ratings:

- Fitch: BB stable

- Moody's: Ba2 stable

- S&P: BB- stable

- BPI: B

- Transparency: 58/100

- OECD: 6

The French economic presence is strengthening

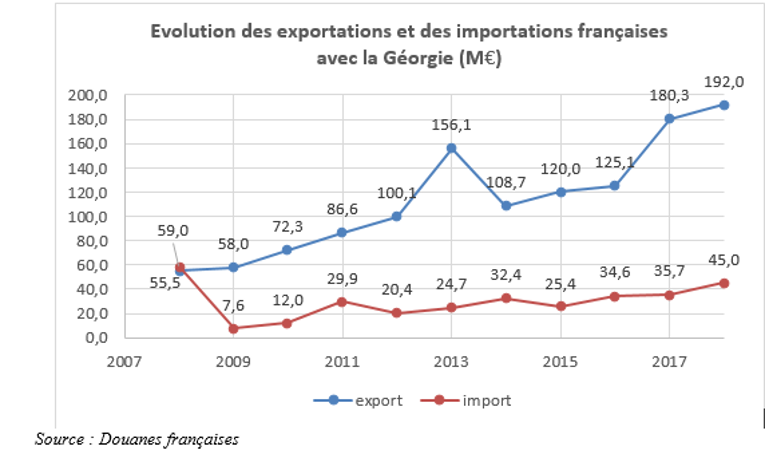

Georgia is France's largest market in the Caucasus, with whom it has a structural and growing trade surplus.

French exports: + 6.4% in 2018 (+ 44% in 2017) to 192 Billion EUR.

Main exports:

- pharmaceuticals 26% of exports (+ 0.4%);

- equipment 25% (+ 380%);

- chemicals 14.12% (+ 18.9%);

- LPN products 12% of exports (+ 2.1%);

Imports: + 26.6% to 45 Billion EUR.

Purchases of distilled alcoholic beverages 40% (+ 43%)

Market share: 2.88% (1.69% in 2017).

French companies have invested in traditional sectors:

- transport,

- agribusiness,

- commercial real estate,

- mechanical industry,

- recently

Bilateral trade: surplus and rising exports

Evolutions of the French's export and import with Georgia (Billion EUR)

Exports dominated by equipment and pharmacy

French export

Bilateral trade: progress in 2018

Evolution of the market shares

Energy, equipment and agriculture sectors of opportunity

- Gas, hydroelectricity; eolian

- Energetic efficiency

- Land Registration and Farmland Ownership Act; seed sector development;

- Geographical Indications

Strong support from donors

Strong presence of multilateral and regional donors (WB, ADB, EU, EIB, EBRD) and bilateral donors (AFD, KfW): infrastructure projects and technical assistance

AFD: opening of the regional office in Tbilisi in dec. 2016

Activities of Proparco, a subsidiary of AFD, for the financing of the private sector, in the banking, health and hydropower sectors.

Relations with Russia and the EEU

2018 exchanges with Russia:second partner (1.4 billion USD, + 15%) behind Azerbaijan since 2018.

Exports to Russia: 447 Billion USD, + 10%

Imports from Russia: 935 Billion USD + 17%.

Industrial base adapted to Russian standards. Russia's share of Georgian exports dropped from 14.5% to 13%.

EEU: trade growth: + 24%.

Georgian imports: 15.9% (15.2% in 2017)

Exports: 25.7% (25.4% in 2017)

Decrease in market shares.

Tourism: 1.4 million Russian tourists in 2018 (23%); 17%; higher expenses; diversified (mountain areas, casino, sea)

FDI: old investments in the energy sector, banking, mining and more recent telecommunications, agribusiness (Borjomi: Alfa- Nestlé).

Energy: 75% of the electricity distribution belongs to INTER; hydroelectric power stations in Gardabani (80% electricity in winter); Khami-1 and 2 etc .; gasoline distribution networks (Lukoil, Gulf); VTB (5% of the market); water supply of the capital; gold mine; telecommunications (Beeline - 8% of the market).